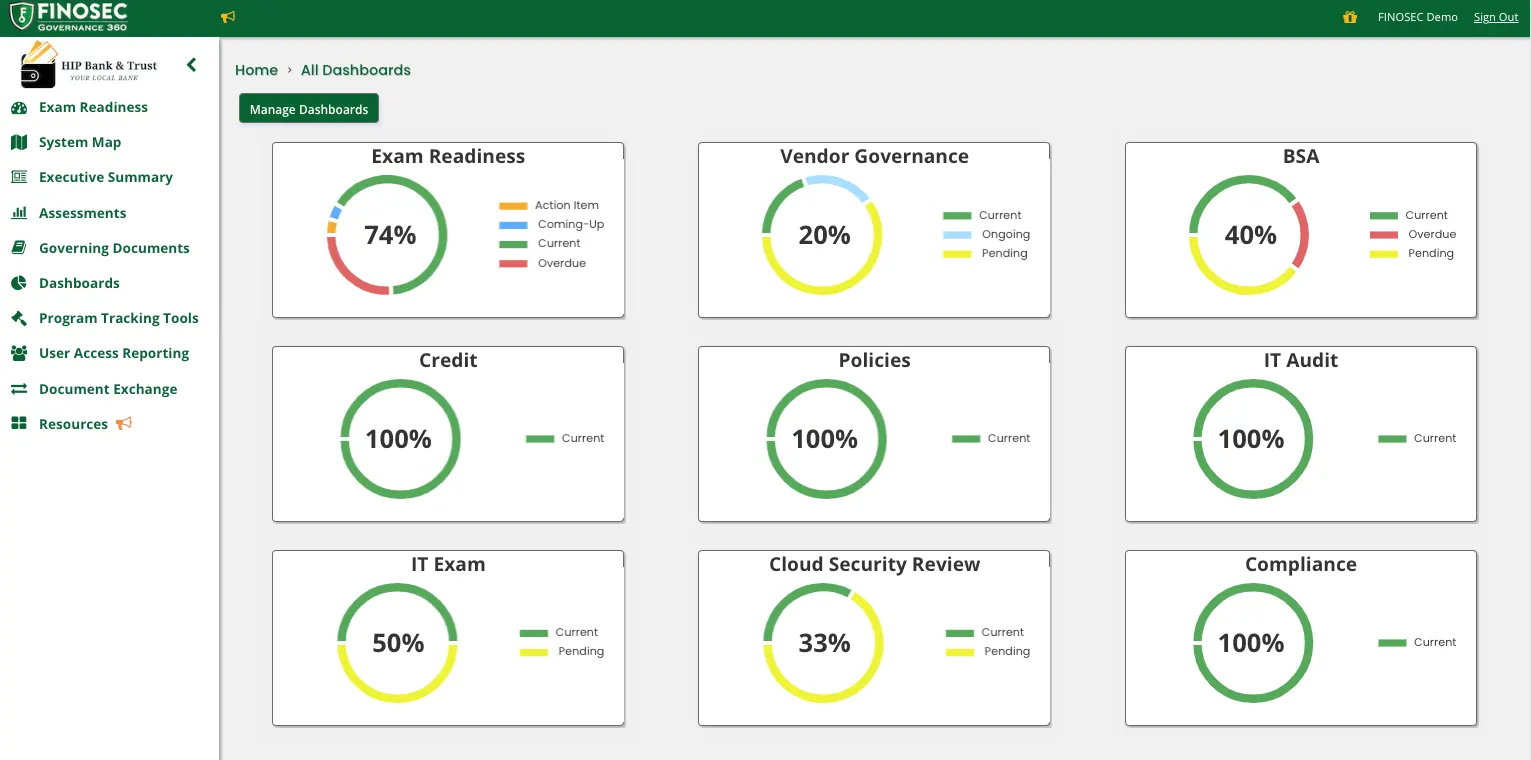

Automate and Elevate with Governance 360

InfoSec Governance

Don’t just manage your governance… master it. Finosec will help you translate difficult regulatory protocols into clear, actionable steps. Our platform optimizes every facet of your governance, ensuring you stay aligned, informed and proactive.

User Access Reporting

Managing who has access to what, when and how is stressful. Our User Access Reporting solution emphasizes clarity, security and simplicity. Let’s streamline your data security compliance and make it easier for your institution to maintain both accessibility and security.

Gain a 360° View of Your Compliance

Keeping up with the ever-changing regulations, risks and requirements in the financial industry is a huge challenge for banks and credit unions. But with Finosec in your corner, your institution will tread new ground instead of just treading water.

We built our compliance automation software to help institutions of all sizes simplify and automate the governance process—so they can focus on their core business. At the heart of our cutting-edge solution is a transformative approach to user access review and a groundbreaking strategy for cybersecurity governance.

With Finosec as your compliance partner, you’ll:

- Watch your cumbersome tasks morph into smooth workflows, thanks to our compliance automation

- Document your systems and the crown jewels you need to protect

- Kickstart your compliance risk assessment with automated tools

- Plan your action items and set clear target dates

- Delegate tasks effortlessly, ensuring the right team member handles the right challenge

- Enjoy the comfort of real-time insight, always knowing where you stand in exam readiness and compliance stature

Simplify

Trouble with User Access Reviews?

View the case study to see how Finosec optimized user access reviews for South Atlantic Bank.

From the Blog

ICBA ThinkTECH Alumnus Finosec Launches Cybersecurity Tool to Support Community Banks Ahead of FFIEC CAT Sunset

Finosec, an ICBA ThinkTECH Accelerator alumnus, today announced the launch of the Finosec Cybersecurity Assessment Tool, developed for community banks navigating the sunset of the FFIEC Cybersecurity Assessment Tool (CAT) in August. Finosec’s assessment tool provides...

Finosec Welcomes Katherine Ring as Chief Growth Officer

Finosec, the purpose-built information security governance platform for community financial institutions, announced the appointment of Katherine Ring as Chief Growth Officer. Katherine brings extensive experience helping organizations scale, drive sustainable revenue,...

Finosec CAT vs. NIST CSF: Operationalize NIST With Inherent Risk and Automation

Why Inherent Risk Still Matters Even if You’ve Already Chosen Your Framework Many community banks have already selected a cybersecurity framework to replace the FFIEC Cybersecurity Assessment Tool (CAT). NIST CSF 2.0 is one of the most popular choices, and for good...

Finosec CAT vs. the CRI Profile: Why Community Banks Need Clear Inherent Risk, Not Impact Tiering

After the August 31st sunset of the FFIEC CAT, community banks have either started to transition away or are confirming their plan and evaluating frameworks such as the Cyber Risk Institute (CRI) Profile, NIST Cybersecurity Framework (CSF 2.0), or CIS Controls. Each...