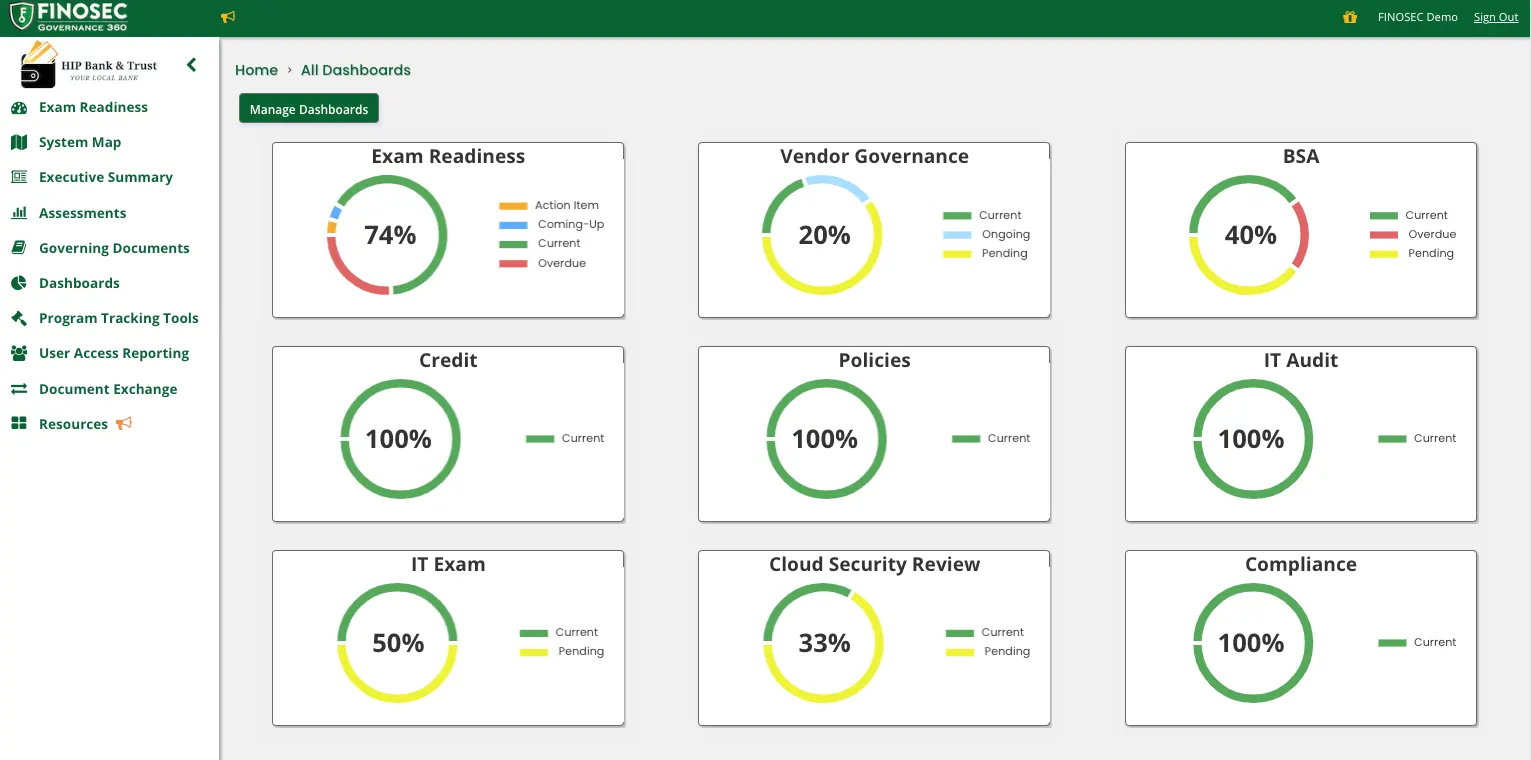

Automate and Elevate with Governance 360

InfoSec Governance

Don’t just manage your governance… master it. Finosec will help you translate difficult regulatory protocols into clear, actionable steps. Our platform optimizes every facet of your governance, ensuring you stay aligned, informed and proactive.

User Access Reporting

Managing who has access to what, when and how is stressful. Our User Access Reporting solution emphasizes clarity, security and simplicity. Let’s streamline your data security compliance and make it easier for your institution to maintain both accessibility and security.

Gain a 360° View of Your Compliance

Keeping up with the ever-changing regulations, risks and requirements in the financial industry is a huge challenge for banks and credit unions. But with Finosec in your corner, your institution will tread new ground instead of just treading water.

We built our compliance automation software to help institutions of all sizes simplify and automate the governance process—so they can focus on their core business. At the heart of our cutting-edge solution is a transformative approach to user access review and a groundbreaking strategy for cybersecurity governance.

With Finosec as your compliance partner, you’ll:

- Watch your cumbersome tasks morph into smooth workflows, thanks to our compliance automation

- Document your systems and the crown jewels you need to protect

- Kickstart your compliance risk assessment with automated tools

- Plan your action items and set clear target dates

- Delegate tasks effortlessly, ensuring the right team member handles the right challenge

- Enjoy the comfort of real-time insight, always knowing where you stand in exam readiness and compliance stature

Simplify

Trouble with User Access Reviews?

View the case study to see how Finosec optimized user access reviews for South Atlantic Bank.

From the Blog

Finosec Forward: Purpose Beyond Profit

At Finosec, our mission has always been about more than technology, it’s about people, community, and purpose. That belief is embodied in Finosec Forward, our intentional effort to make a positive impact beyond the world of cybersecurity governance. This isn’t a side...

What Banks Need For a Cybersecurity Assessment

Cybersecurity is no longer just an IT concern. For community banks, it is a core part of risk management, regulatory compliance, and board level governance. Yet many institutions still struggle to answer two basic questions: Are we doing enough? Can we prove it? These...

A Small Gift, a Lasting Lesson, and Our Thanks to the Finosec Community

Every Thanksgiving, each of our clients receive a gift from us; simple glass jars filled with wintergreen mints. If yours is still sitting on your desk, maybe you’ve wondered, why mints? Why that particular gift? They’re personal to me. My dad loved wintergreen mints,...

Finosec Accelerates Product Innovation in 2025, Supporting a Growing Community of Financial Institutions

Finosec, a cybersecurity governance Saas company, announced a year of rapid product innovation in 2025, delivering over one hundred enhancements across its platform to help community banks and credit unions respond to increasing regulatory pressure, operational...