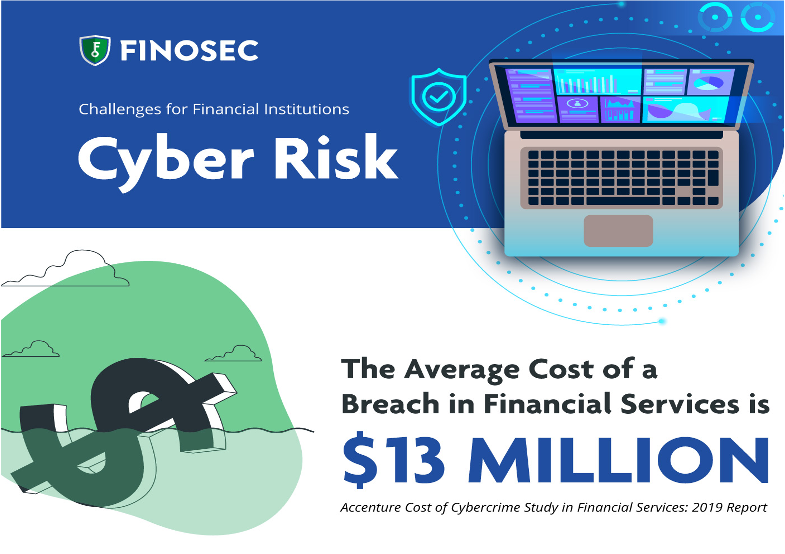

The sophistication of cyber attacks continues to grow. According to the Accenture Cost of Cybercrime Study, the average cost of a breach in financial services is $13 Million. As a financial institution, we have to be right 100% of the time while Cyber Criminals only need to be right once.

The impact of these cyber attacks is substantial. With an ever-evolving landscape of cyber attacks, it is important to keep pace with trends. The same Cost of Cybercrime Study found that cyber attacks are changing due to: evolving targets, evolving impact, and evolving techniques.

Evolving targets– Information theft is the most expensive and fastest rising consequence of cybercrime – but data is not the only target. Banking systems with access to financial transactions are being attacked as well.

Evolving impact – Recent cyber attacks are not only copying data but also destroying or encrypting it for ransom. This causes a level of distrust and corrodes influence.

Evolving techniques – Cyber criminals are perfecting their attack methods. There has been an increase in phishing and malware attacks.

As we see digital dependency rise, we are also seeing cyber risk increase. We are seeing that employees, whether intentionally or by mistake, often being the root cause of successful cyberattacks. Humans are the weakest link when it comes to cybersecurity. Employees need the tools and education to help them address cyber risk as well as current trends to help them know what to look out for. We believe that they also need community. A place of likeminded professionals who want to learn more about how they can help reduce cyber risk at their institution.

We created Finosec Academy for this specific reason. It houses downloadable content, access to current events and articles, as well as the benefit of an innovative community. We also provide courses where you can learn and grow in the cybersecurity industry.

To have access to the information mentioned in this post and view the Accenture Cost of Cybercrime Study, click here.

We understand that cybersecurity and information security can be stressful. Our Governance Automation Platform (G.A.P.) comes along side of you and provides a proven blueprint in banking cybersecurity.